Introduction to Shiny

Outline

- This lecture is mainly based the following textbooks:

- Mastering Shiny (Wickham 2021)

- R for Data Science (Wickham, Mine Cetinkaya-Rundel, and Grolemund 2023)

Coding Replications

For coding replications, whenever applicable, please follow this page or hover on the specific slides with containing coding chunks.

- Ensure that you have your session properly set-up according to the instructions outlined in the course webpage

- In the webpage, you can also find a detailed discussion of the examples covered in this lecture

Disclaimer

Disclaimer

The information presented in this lecture is for educational and informational purposes only and should not be construed as investment advice. Nothing discussed constitutes a recommendation to buy, sell, or hold any financial instrument or security. Investment decisions should be made based on individual research and consultation with a qualified financial professional. The presenter assumes no responsibility for any financial decisions made based on this content.

All code used in this lecture is publicly available and is also shared on my GitHub page. Participants are encouraged to review, modify, and use the code for their own learning and research purposes. However, no guarantees are made regarding the accuracy, completeness, or suitability of the code for any specific application.

For any questions or concerns, please feel free to reach out via email at lucas.macoris@fgv.br

What else?

- During this semester, you have been exposed to a series of practical applications in topics related to finance:

- Collecting and manipulating data

- Backtesting Investment Strategies

- Evaluating Mutual Fund performance

- Stress-testing Equity Valuation Models

- Analyzing M&A announcements and marketing sentiment around news

What’s left for us to do?

It is time to ship your insights to a broader audience - I introduce you Shiny!

Introduction to Shiny

It allows for real-time data visualization and analysis using a web browser, updating outputs automatically when inputs change

Recently, its usage has been extended to

Pythonusers, offering similar reactive programming

Key Features

Easy integration with

ggplot2,dplyr, and othertidyversetools, with customizable UI layouts using built-in layout functions, or plainHTMLandCSSSupports user input through sliders, dropdowns, buttons, and more

Easy to deploy, host, and ship your application to the internet!

Typical Use Cases

Shiny can be used in a variety of contexts, including but not limited to:

Interactive Dashboards and Reports: whether you have inputs that change over time, or need, Shiny can leverage user interaction by asking inputs and also providing interactivity, such as downloading results

Prototyping Data Science products: creating a minimum-viable-product using Shiny is one way of testing an idea before allocating a substantial amount of resources into it. Shiny Apps are simple yet powerful, and can be customized using the best resources on

HTML,JavaScript, andCSSTools for non-technical stakeholders: Shiny helps to bridge the gap between

RandPythonusers with non-technical audiences, allowing different agents to draw insights from the data without the need for extensive coding

Example #1: a geographical deep-dive through the U.S

Example #2: a historical movie explorer

Example #3: a momentum-based backtester

Shiny App Structure (getting started)

A general purpose Shiny app has the following structure:

- The

ui: defines the layout and appearance of the app (i.e, the frontend) - The

server: Defines the logic and behavior of the app (i.e, the backend) - Finally, the

shinyAppfunction creates app objects from an explicit UI/server pair:

- The

- This function uses the

uiandserverdefinition and launches a local app in your browser for quick visualization and troubleshooting

How it works

Every Shiny app has the same structure: an

app.Rfile that containsuiandserverYou can create a Shiny app by making a new directory and saving an

app.Rfile inside it. It is recommended that each app will live in its own unique directory

My very first app

A minimal working example (in finance)

- You boss got impressed with the analysis you did as a buy-side analyst at Pierpoint Capital. Unfortunately, he did not take the Practical Applications in Quantitative Finance course, so he really can’t replicate your findings. Your task is to help him ship your analysis to the whole organization

- Create stunning visuals that allow interactivity

- Allow users to change parameters of your analysis

- Finally, provide users with the ability to download their findings

Specific Instructions

We will be extensively using several contents from (Wickham 2021). For the sake of brevity, we will not dive into the nitty-gritty details, but rather explore some functions that can be used within a Shiny context

We will leverage ShinyAI, an LLM specifically desined to help developing a web framework for data driven apps. You can ask questions about how to use Shiny, to explain how certain things work, or even ask to build a Shiny app for you.

My first Shiny app

In what follows, we will begin by creating a very simply app that provides a summary performance of selected stocks over time, constructed using the following UI/UX structure:

Users provide a start and end date for the analysis of the Magnificent 7 stocks

The expected outcome should be a chart that compares the cumulative returns of all selected assets over time

Each section will contain three tabs:

The Outline section will provide a very quick explanation of what we need to add to the app

The Prompt section describes what we will be asking ShinyAI to help us with - as expected, this should be a trial-and-error process between prompts

Finally, the Code section will contain the updated code generated by ShinyAI, which can be fed into your

Rsection

Create a Shiny app that visualizes the cumulative returns of the 'Magnificent 7' tech stocks (Apple, Microsoft, Amazon, NVIDIA, Alphabet/Google, Meta/Facebook, and Tesla). The app should have the following features:

The only user input should be a date range selector in the sidebar, with a default range of the past year and a minimum selectable date of January 1, 2015

Display a line chart showing the cumulative returns of all Magnificent 7 stocks over the selected time period, with company names shown in the legend instead of ticker symbols

Include a data table below the chart that summarizes key performance metrics for each stock: company name, start date, end date, total return, annualized return, and volatility

Use the tidyquant package to download stock price data from Yahoo Finance and calculate the returns

Use the tidyverse for data manipulation and ggplot2 for visualizationlibrary(shiny)

library(tidyverse)

library(tidyquant)

library(bslib)

library(scales)

# Define the Magnificent 7 stocks

magnificent_7 <- c(

"AAPL", # Apple

"MSFT", # Microsoft

"AMZN", # Amazon

"NVDA", # NVIDIA

"GOOGL", # Alphabet (Google)

"META", # Meta (Facebook)

"TSLA" # Tesla

)

ui <- page_sidebar(

title = "Magnificent 7 Return Comparison",

sidebar = sidebar(

title = "Date Range",

dateRangeInput(

"date_range",

"Select date range:",

start = Sys.Date() - 365,

end = Sys.Date(),

min = "2015-01-01",

max = Sys.Date()

)

),

card(

full_screen = TRUE,

card_header("Cumulative Returns of Magnificent 7 Stocks"),

plotOutput("returns_plot", height = "500px")

),

card(

card_header("Performance Summary"),

dataTableOutput("data_summary")

)

)

server <- function(input, output, session) {

# Reactive expression to get and process stock data

stock_data <- reactive({

# Validate that we have dates

req(input$date_range)

# Download data

tq_data <- tq_get(

magnificent_7,

from = input$date_range[1],

to = input$date_range[2],

get = "stock.prices"

)

# Check if we got data

req(nrow(tq_data) > 0)

# Calculate daily returns

returns_data <- tq_data %>%

group_by(symbol) %>%

tq_transmute(

select = adjusted,

mutate_fun = periodReturn,

period = "daily",

col_rename = "daily_return"

)

# Calculate cumulative returns

cum_returns <- returns_data %>%

group_by(symbol) %>%

mutate(cumulative_return = cumprod(1 + daily_return) - 1) %>%

ungroup()

list(

raw_data = tq_data,

cum_returns = cum_returns

)

})

# Generate returns plot

output$returns_plot <- renderPlot({

req(stock_data())

cum_returns <- stock_data()$cum_returns

# Create a named vector for better labels

stock_names <- c(

"AAPL" = "Apple",

"MSFT" = "Microsoft",

"AMZN" = "Amazon",

"NVDA" = "NVIDIA",

"GOOGL" = "Alphabet",

"META" = "Meta",

"TSLA" = "Tesla"

)

ggplot(cum_returns, aes(x = date, y = cumulative_return, color = symbol)) +

geom_line(linewidth = 1) +

scale_y_continuous(labels = percent) +

scale_color_discrete(labels = stock_names) +

labs(

title = "Cumulative Returns of Magnificent 7 Tech Stocks",

x = "Date",

y = "Cumulative Return",

color = "Company"

) +

theme_minimal() +

theme(

legend.position = "bottom",

legend.box = "horizontal",

plot.title = element_text(hjust = 0.5, face = "bold", size = 16),

axis.title = element_text(face = "bold"),

legend.title = element_text(face = "bold")

)

})

# Generate data summary

output$data_summary <- renderDataTable({

req(stock_data())

cum_returns <- stock_data()$cum_returns

# Stock display names for the summary table

stock_names <- c(

"AAPL" = "Apple",

"MSFT" = "Microsoft",

"AMZN" = "Amazon",

"NVDA" = "NVIDIA",

"GOOGL" = "Alphabet",

"META" = "Meta",

"TSLA" = "Tesla"

)

# Summary statistics for each asset

summary_data <- cum_returns %>%

group_by(symbol) %>%

summarize(

Start_Date = min(date),

End_Date = max(date),

Total_Return = last(cumulative_return) %>% round(4),

Annualized_Return = ((1 + last(cumulative_return))^(252 / n())) - 1 %>% round(4),

Volatility = sd(daily_return, na.rm = TRUE) * sqrt(252) %>% round(4)

) %>%

mutate(

Company = stock_names[symbol],

Total_Return = percent(Total_Return, accuracy = 0.01),

Annualized_Return = percent(Annualized_Return, accuracy = 0.01),

Volatility = percent(Volatility, accuracy = 0.01)

) %>%

select(Company, Start_Date, End_Date, Total_Return, Annualized_Return, Volatility)

})

}

shinyApp(ui, server)#1: Adding a stock selector

- You are off to a good start - however, there are some important points to consider:

- Users may want to select stocks other than the Magnificent Seven

- Notwithstanding, asking users to write down the list of assets is too cumbersome, let alone the fact that this is highly prone to human error

- Because of that, you could ask them to select from a predefined drop-down list that contains a list of valid tickers

- In what follows, we will add a drop-down menu that contains all S&P ticker constituents that can be retrieved from the

tq_indexfunction, allowing users to select the set of stocks that will be part of the analysis

This is great! Now, I need to add a stock selector. Use the tq_index() function to retrieve all tickers from S&P500. Add the following structure to the app:

1. Remove the Magnificent Seven. The default selector should have zero stocks.

2. Add a drop-down menu with all the stocks from the `tq_index('SP500')` function. Allow for a "Select All" button.library(shiny)

library(tidyverse)

library(tidyquant)

library(bslib)

library(scales)

library(shinyWidgets) # Added for pickerInput

# Get S&P 500 tickers and industry information

sp500_stocks <- tq_index("SP500") %>%

select(symbol, company, sector) %>%

arrange(sector, company)

ui <- page_sidebar(

title = "S&P 500 Return Comparison",

sidebar = sidebar(

title = "Settings",

dateRangeInput(

"date_range",

"Select date range:",

start = Sys.Date() - 365,

end = Sys.Date(),

min = "2015-01-01",

max = Sys.Date()

),

hr(),

# Stock selector with search functionality

pickerInput(

inputId = "stock_selector",

label = "Select Stocks:",

choices = setNames(sp500_stocks$symbol, paste0(sp500_stocks$symbol, " - ", sp500_stocks$company)),

selected = NULL, # Default to no selection

multiple = TRUE,

options = list(

`actions-box` = TRUE,

`live-search` = TRUE,

`selected-text-format` = "count > 3",

`count-selected-text` = "{0} stocks selected"

)

)

),

card(

full_screen = TRUE,

card_header("Cumulative Returns Comparison"),

plotOutput("returns_plot", height = "500px")

),

card(

card_header("Performance Summary"),

dataTableOutput("data_summary")

)

)

server <- function(input, output, session) {

# Reactive to store current stock selection

selected_stocks <- reactiveVal(NULL) # Start with no stocks selected

# Update selected_stocks when stock_selector changes

observeEvent(input$stock_selector, {

selected_stocks(input$stock_selector)

})

# Get full list of stocks to retrieve

stocks_to_get <- reactive({

stocks <- selected_stocks()

# Ensure we have at least one stock to display

if (length(stocks) == 0) {

return(NULL)

}

return(stocks)

})

# Reactive expression to get and process stock data

stock_data <- reactive({

# Validate that we have dates and stocks

req(input$date_range)

req(length(stocks_to_get()) > 0)

# Download data

tq_data <- tq_get(

stocks_to_get(),

from = input$date_range[1],

to = input$date_range[2],

get = "stock.prices"

)

# Check if we got data

req(nrow(tq_data) > 0)

# Calculate daily returns

returns_data <- tq_data %>%

group_by(symbol) %>%

tq_transmute(

select = adjusted,

mutate_fun = periodReturn,

period = "daily",

col_rename = "daily_return"

)

# Calculate cumulative returns

cum_returns <- returns_data %>%

group_by(symbol) %>%

mutate(cumulative_return = cumprod(1 + daily_return) - 1) %>%

ungroup()

list(

raw_data = tq_data,

cum_returns = cum_returns

)

})

# Get company names for better labels

stock_names <- reactive({

# Create lookup from sp500 stocks

name_lookup <- setNames(sp500_stocks$company, sp500_stocks$symbol)

})

# Generate returns plot

output$returns_plot <- renderPlot({

req(stock_data())

cum_returns <- stock_data()$cum_returns

names_lookup <- stock_names()

# Limit the number of stocks shown for better visualization

if(nrow(cum_returns) > 0) {

ggplot(cum_returns, aes(x = date, y = cumulative_return, color = symbol)) +

geom_line(linewidth = 1) +

scale_y_continuous(labels = percent) +

scale_color_discrete(labels = function(x) ifelse(x %in% names(names_lookup), names_lookup[x], x)) +

labs(

title = "Cumulative Returns Comparison",

x = "Date",

y = "Cumulative Return",

color = "Company"

) +

theme_minimal() +

theme(

legend.position = "bottom",

legend.box = "horizontal",

plot.title = element_text(hjust = 0.5, face = "bold", size = 16),

axis.title = element_text(face = "bold"),

legend.title = element_text(face = "bold")

)

}

})

# Generate data summary

output$data_summary <- renderDataTable({

req(stock_data())

cum_returns <- stock_data()$cum_returns

names_lookup <- stock_names()

# Summary statistics for each asset

summary_data <- cum_returns %>%

group_by(symbol) %>%

summarize(

Start_Date = min(date),

End_Date = max(date),

Total_Return = last(cumulative_return) %>% round(4),

Annualized_Return = ((1 + last(cumulative_return))^(252 / n())) - 1 %>% round(4),

Volatility = sd(daily_return, na.rm = TRUE) * sqrt(252) %>% round(4)

) %>%

mutate(

Company = ifelse(symbol %in% names(names_lookup), names_lookup[symbol], symbol),

Total_Return = percent(Total_Return, accuracy = 0.01),

Annualized_Return = percent(Annualized_Return, accuracy = 0.01),

Volatility = percent(Volatility, accuracy = 0.01)

) %>%

select(symbol, Company, Start_Date, End_Date, Total_Return, Annualized_Return, Volatility)

})

}

shinyApp(ui, server)#2: Adding Interactivity

Hooray! You have a minimal working solution for all S&P 500 stocks covered in Yahoo! Finance. It is now time to look at the aesthetics:

- As you increase the number of stocks, understanding the line chart becomes increasingly difficult

- One way to enhance the user experience is to add interactivity to your chart, allowing users to hover on specific data points, filtering the date ranges directly in the chart, and zoom in/out on a specific region

In what follows, we will change the charting engine from

ggplot2tohighcharter, a solution that allows for interactive time-series visualization

This is great! Now, I need to change the way that the chart aesthetics are looking. Please considers the instructions below:

1. Change the plotting engine from ggplot2 to highcharter, using the `hchart` function to create a line chart

2. Allow for time range selectors and, when users hover on a specific data point, use the tooltip to show the cumulative return up to that point, and the stock name. The tooltip and the y-axis must show the cumulative returns with the following format: '0.X%"library(shiny)

library(tidyverse)

library(tidyquant)

library(bslib)

library(scales)

library(shinyWidgets) # For pickerInput

library(highcharter) # For interactive charts

# Get S&P 500 tickers and industry information

sp500_stocks <- tq_index("SP500") %>%

select(symbol, company, sector) %>%

arrange(sector, company)

ui <- page_sidebar(

title = "S&P 500 Return Comparison",

sidebar = sidebar(

title = "Settings",

dateRangeInput(

"date_range",

"Select date range:",

start = Sys.Date() - 365,

end = Sys.Date(),

min = "2015-01-01",

max = Sys.Date()

),

hr(),

# Stock selector with search functionality

pickerInput(

inputId = "stock_selector",

label = "Select Stocks:",

choices = setNames(sp500_stocks$symbol, paste0(sp500_stocks$symbol, " - ", sp500_stocks$company)),

selected = NULL, # Default to no selection

multiple = TRUE,

options = list(

`actions-box` = TRUE,

`live-search` = TRUE,

`selected-text-format` = "count > 3",

`count-selected-text` = "{0} stocks selected"

)

)

),

card(

full_screen = TRUE,

card_header("Cumulative Returns Comparison"),

highchartOutput("returns_plot", height = "500px")

),

card(

card_header("Performance Summary"),

dataTableOutput("data_summary")

)

)

server <- function(input, output, session) {

# Reactive to store current stock selection

selected_stocks <- reactiveVal(NULL) # Start with no stocks selected

# Update selected_stocks when stock_selector changes

observeEvent(input$stock_selector, {

selected_stocks(input$stock_selector)

})

# Get full list of stocks to retrieve

stocks_to_get <- reactive({

stocks <- selected_stocks()

# Ensure we have at least one stock to display

if (length(stocks) == 0) {

return(NULL)

}

return(stocks)

})

# Reactive expression to get and process stock data

stock_data <- reactive({

# Validate that we have dates and stocks

req(input$date_range)

req(length(stocks_to_get()) > 0)

# Download data

tq_data <- tq_get(

stocks_to_get(),

from = input$date_range[1],

to = input$date_range[2],

get = "stock.prices"

)

# Check if we got data

req(nrow(tq_data) > 0)

# Calculate returns

returns_data <- tq_data %>%

group_by(symbol) %>%

arrange(date) %>%

# Calculate daily returns

tq_transmute(

select = adjusted,

mutate_fun = periodReturn,

period = "daily",

col_rename = "daily_return"

)

# Join the returns data with original price data

returns_with_prices <- returns_data %>%

left_join(

tq_data %>% select(symbol, date, adjusted),

by = c("symbol", "date")

)

# Calculate cumulative returns from the first date of the period

cum_returns <- returns_with_prices %>%

group_by(symbol) %>%

arrange(date) %>%

mutate(

# For each stock, calculate the cumulative return starting from the first date

cumulative_return = cumprod(1 + daily_return) - 1

) %>%

ungroup()

list(

raw_data = tq_data,

cum_returns = cum_returns

)

})

# Get company names for better labels

stock_names <- reactive({

# Create lookup from sp500 stocks

name_lookup <- setNames(sp500_stocks$company, sp500_stocks$symbol)

# Return

name_lookup

})

# Generate returns plot with highcharter

output$returns_plot <- renderHighchart({

req(stock_data())

cum_returns <- stock_data()$cum_returns

names_lookup <- stock_names()

# Convert to format suitable for highcharter

if(nrow(cum_returns) > 0) {

# Create highchart

hc <- highchart(type = "stock") %>%

hc_title(text = "Cumulative Returns Comparison") %>%

hc_xAxis(type = "datetime",

title = list(text = "Date"),

dateTimeLabelFormats = list(

day = '%e of %b',

month = '%b %Y',

year = '%Y'

)) %>%

hc_yAxis(

title = list(text = "Cumulative Return"),

labels = list(formatter = JS("function() { return (this.value * 100).toFixed(2) + '%'; }"))

) %>%

hc_tooltip(

headerFormat = '<span style="font-size: 10px">{point.key}</span><br/>',

pointFormatter = JS("function() { return '<span style=\"color:' + this.color + '\">●</span> <b>' + this.series.name + '</b>: <b>' + (this.y * 100).toFixed(2) + '%</b><br/>'; }"),

shared = TRUE,

crosshairs = TRUE

) %>%

hc_plotOptions(series = list(

marker = list(enabled = FALSE),

states = list(hover = list(lineWidthPlus = 0))

)) %>%

hc_legend(enabled = TRUE)

# Add data for each stock

for(stock in unique(cum_returns$symbol)) {

stock_data <- cum_returns %>%

filter(symbol == stock) %>%

select(date, cumulative_return)

# Get proper company name

company_name <- ifelse(stock %in% names(names_lookup),

names_lookup[stock],

stock)

# Format data for highcharter - simplified approach

hc_data <- stock_data %>%

mutate(

x = datetime_to_timestamp(date),

y = cumulative_return # Keep as decimal for proper calculations

) %>%

select(x, y) %>%

list_parse2()

# Add series to chart

hc <- hc %>%

hc_add_series(

data = hc_data,

name = paste0(stock, " - ", company_name),

type = "line"

)

}

# Return the chart

hc

}

})

# Generate data summary

output$data_summary <- renderDataTable({

req(stock_data())

cum_returns <- stock_data()$cum_returns

names_lookup <- stock_names()

# Summary statistics for each asset

summary_data <- cum_returns %>%

group_by(symbol) %>%

summarize(

Start_Date = min(date),

End_Date = max(date),

Total_Return = last(cumulative_return) %>% round(4),

Annualized_Return = ((1 + last(cumulative_return))^(252 / n())) - 1 %>% round(4),

Volatility = sd(daily_return, na.rm = TRUE) * sqrt(252) %>% round(4)

) %>%

mutate(

Company = ifelse(symbol %in% names(names_lookup), names_lookup[symbol], symbol),

Total_Return = percent(Total_Return, accuracy = 0.01),

Annualized_Return = percent(Annualized_Return, accuracy = 0.01),

Volatility = percent(Volatility, accuracy = 0.01)

) %>%

select(symbol, Company, Start_Date, End_Date, Total_Return, Annualized_Return, Volatility)

})

}

shinyApp(ui, server)#3: Aesthetic Adjustments

You’re on a streak! You app is looking neat: you should consider showcasing that!

Before you do that, let’s make sure users can get the most of your app while interacting:

- The width of the sidebar needs to be increased a little bit to allow for text to be displayed

- The dropdown menu section needs to be more organized

- Finally, you can also make the charts and the table to look nicer by changing the size of the line charts and renaming the column names to be displayed in Title Format

In what follows, we will ask for these changes with simple instructions to tweak the current code

Ok, this is looking neat! Now, I need you to change a few points:

1. Increase the width of the sidebar by 25%

2. Use the pickerInput() from the shinyWidgets package to select the stocks. It should be a combination of the form "ticker (Company)"

3. Increase the size of the lines in the hchart() call

4. Rename the column names in the table and make it in proper format (e.g, remove underlines and ensure Title Format)library(shiny)

library(tidyverse)

library(tidyquant)

library(bslib)

library(scales)

library(shinyWidgets) # For pickerInput and dropdownButton

library(highcharter) # For interactive charts

# Get S&P 500 tickers and industry information

sp500_stocks <- tq_index("SP500") %>%

select(symbol, company, sector) %>%

arrange(sector, company)

# Create choices with company name as supplementary info in front of ticker

# Format: "Company Name (TICKER)"

ticker_labels <- paste0(sp500_stocks$company, " (", sp500_stocks$symbol, ")")

ticker_choices <- setNames(sp500_stocks$symbol, ticker_labels)

ui <- page_sidebar(

title = "S&P 500 Return Comparison",

sidebar = sidebar(

title = "Settings",

width = 440, # Increased width

dateRangeInput(

"date_range",

"Select date range:",

start = Sys.Date() - 365,

end = Sys.Date(),

min = "2015-01-01",

max = Sys.Date()

),

hr(),

# Use dropdownButton for stock selection

dropdownButton(

inputId = "dropdown_stocks",

label = "Select Stocks",

icon = icon("filter"),

status = "primary",

width = "100%",

circle = FALSE,

# Stock selector with search functionality

pickerInput(

inputId = "stock_selector",

label = "Select Stocks:",

choices = ticker_choices,

options = list(

`actions-box` = TRUE,

`live-search` = TRUE,

`selected-text-format` = "count > 3",

`count-selected-text` = "{0} stocks selected"

),

selected = NULL, # Default to no selection

multiple = TRUE,

width = "100%"

)

)

),

card(

full_screen = TRUE,

card_header("Cumulative Returns Comparison"),

highchartOutput("returns_plot", height = "500px")

),

card(

card_header("Performance Summary"),

dataTableOutput("data_summary")

)

)

server <- function(input, output, session) {

# Reactive to store current stock selection

selected_stocks <- reactiveVal(NULL) # Start with no stocks selected

# Update selected_stocks when stock_selector changes

observeEvent(input$stock_selector, {

selected_stocks(input$stock_selector)

})

# Get full list of stocks to retrieve

stocks_to_get <- reactive({

stocks <- selected_stocks()

# Ensure we have at least one stock to display

if (length(stocks) == 0) {

return(NULL)

}

return(stocks)

})

# Reactive expression to get and process stock data

stock_data <- reactive({

# Validate that we have dates and stocks

req(input$date_range)

req(length(stocks_to_get()) > 0)

# Download data

tq_data <- tq_get(

stocks_to_get(),

from = input$date_range[1],

to = input$date_range[2],

get = "stock.prices"

)

# Check if we got data

req(nrow(tq_data) > 0)

# Calculate returns

returns_data <- tq_data %>%

group_by(symbol) %>%

arrange(date) %>%

# Calculate daily returns

tq_transmute(

select = adjusted,

mutate_fun = periodReturn,

period = "daily",

col_rename = "daily_return"

)

# Join the returns data with original price data

returns_with_prices <- returns_data %>%

left_join(

tq_data %>% select(symbol, date, adjusted),

by = c("symbol", "date")

)

# Calculate cumulative returns from the first date of the period

cum_returns <- returns_with_prices %>%

group_by(symbol) %>%

arrange(date) %>%

mutate(

# For each stock, calculate the cumulative return starting from the first date

cumulative_return = cumprod(1 + daily_return) - 1

) %>%

ungroup()

list(

raw_data = tq_data,

cum_returns = cum_returns

)

})

# Get company names for better labels

stock_names <- reactive({

# Create lookup from sp500 stocks

name_lookup <- setNames(sp500_stocks$company, sp500_stocks$symbol)

# Return

name_lookup

})

# Generate returns plot with highcharter

output$returns_plot <- renderHighchart({

req(stock_data())

cum_returns <- stock_data()$cum_returns

names_lookup <- stock_names()

# Convert to format suitable for highcharter

if(nrow(cum_returns) > 0) {

# Create highchart

hc <- highchart(type = "stock") %>%

hc_title(text = "Cumulative Returns Comparison") %>%

hc_xAxis(type = "datetime",

title = list(text = "Date"),

dateTimeLabelFormats = list(

day = '%e of %b',

month = '%b %Y',

year = '%Y'

)) %>%

hc_yAxis(

title = list(text = "Cumulative Return"),

labels = list(formatter = JS("function() { return (this.value * 100).toFixed(2) + '%'; }"))

) %>%

hc_tooltip(

headerFormat = '<span style="font-size: 10px">{point.key}</span><br/>',

pointFormatter = JS("function() { return '<span style=\"color:' + this.color + '\">●</span> <b>' + this.series.name + '</b>: <b>' + (this.y * 100).toFixed(2) + '%</b><br/>'; }"),

shared = TRUE,

crosshairs = TRUE

) %>%

hc_plotOptions(series = list(

marker = list(enabled = FALSE),

states = list(hover = list(lineWidthPlus = 0)),

lineWidth = 3 # Increased line thickness

)) %>%

hc_legend(enabled = TRUE)

# Add data for each stock

for(stock in unique(cum_returns$symbol)) {

stock_data <- cum_returns %>%

filter(symbol == stock) %>%

select(date, cumulative_return)

# Format data for highcharter - simplified approach

hc_data <- stock_data %>%

mutate(

x = datetime_to_timestamp(date),

y = cumulative_return # Keep as decimal for proper calculations

) %>%

select(x, y) %>%

list_parse2()

# Add series to chart - only use the ticker symbol in the name

hc <- hc %>%

hc_add_series(

data = hc_data,

name = stock,

type = "line"

)

}

# Return the chart

hc

}

})

# Generate data summary

output$data_summary <- renderDataTable({

req(stock_data())

cum_returns <- stock_data()$cum_returns

names_lookup <- stock_names()

# Summary statistics for each asset

summary_data <- cum_returns %>%

group_by(symbol) %>%

summarize(

Start_Date = min(date),

End_Date = max(date),

Total_Return = last(cumulative_return) %>% round(4),

Annualized_Return = ((1 + last(cumulative_return))^(252 / n())) - 1 %>% round(4),

Volatility = sd(daily_return, na.rm = TRUE) * sqrt(252) %>% round(4)

) %>%

mutate(

Company = ifelse(symbol %in% names(names_lookup), names_lookup[symbol], symbol),

Total_Return = percent(Total_Return, accuracy = 0.01),

Annualized_Return = percent(Annualized_Return, accuracy = 0.01),

Volatility = percent(Volatility, accuracy = 0.01)

) %>%

select(

Symbol = symbol,

Company,

`Start Date` = Start_Date,

`End Date` = End_Date,

`Total Return` = Total_Return,

`Annualized Return` = Annualized_Return,

Volatility

)

})

}

shinyApp(ui, server) #4: Final Adjustments

Like a pro! Your app is now looking like it’s something you would pay for!

Before you showcase that to our boss, remember: you should make sure the app is not crashing due to user interaction:

For example, if a user selects “All Stocks”,

tq_get()will automatically start downloading a lot of data - which might break the serverFurthermore, users should have the ability to confirm their selections and, eventually, download a summary of their findings. The submit button should send an alert saying that the list has been submitted and results will appear soon.

In what follows, we will create some selection handling procedures and insert a Download Button that creates a downloadable

.csvfile

Way to go! Now, here's a list of final adjustments to be made:

1. Create a "Submit List" button that, when triggered, will update the charts and tables. The app shouldn't update without that.

2. Allow for dark mode using a switch button in the header

3. Create a download button that, when triggered, saves a .csv file with the contents from the top panel (time series of cumulative returns for each stock). The submit button should send an alert saying that the list has been submitted and results will appear soon using the sendSweetAlert() function.

4. Add icons in the title, Settings, and Submit configuration buttons library(shiny)

library(tidyverse)

library(tidyquant)

library(bslib)

library(scales)

library(shinyWidgets) # For pickerInput, dropdownButton, and sweetAlert

library(highcharter) # For interactive charts

# Get S&P 500 tickers and industry information

sp500_stocks <- tq_index("SP500") %>%

select(symbol, company, sector) %>%

arrange(sector, company)

# Create choices with company name as supplementary info in front of ticker

# Format: "Company Name (TICKER)"

ticker_labels <- paste0(sp500_stocks$company, " (", sp500_stocks$symbol, ")")

ticker_choices <- setNames(sp500_stocks$symbol, ticker_labels)

ui <- page_sidebar(

title = span(icon("chart-line"), "S&P 500 Return Comparison"),

theme = bs_theme(version = 5, preset = "default"),

header = tags$div(

style = "display: flex; justify-content: flex-end; padding: 5px;",

materialSwitch(

inputId = "dark_mode",

label = span(icon("moon"), "Dark Mode"),

status = "primary",

right = TRUE

)

),

sidebar = sidebar(

title = span(icon("gear"), "Settings"),

width = 440, # Increased width

dateRangeInput(

"date_range",

"Select date range:",

start = Sys.Date() - 365,

end = Sys.Date(),

min = "2015-01-01",

max = Sys.Date()

),

hr(),

# Use dropdownButton for stock selection

dropdownButton(

inputId = "dropdown_stocks",

label = span(icon("filter"), "Select Stocks"),

status = "primary",

width = "100%",

circle = FALSE,

# Stock selector with search functionality

pickerInput(

inputId = "stock_selector",

label = "Select Stocks:",

choices = ticker_choices,

options = list(

`actions-box` = TRUE,

`live-search` = TRUE,

`selected-text-format` = "count > 3",

`count-selected-text` = "{0} stocks selected"

),

selected = NULL, # Default to no selection

multiple = TRUE,

width = "100%"

)

),

hr(),

# Submit button that triggers the data update

actionButton(

"submit_btn",

span(icon("paper-plane"), "Submit List"),

width = "100%",

class = "btn-primary"

)

),

card(

full_screen = TRUE,

card_header(

div(

style = "display: flex; justify-content: space-between; align-items: center;",

span("Cumulative Returns Comparison"),

downloadButton("download_data", "Download Data", class = "btn-sm btn-outline-primary")

)

),

highchartOutput("returns_plot", height = "500px")

),

card(

card_header("Performance Summary"),

dataTableOutput("data_summary")

)

)

server <- function(input, output, session) {

# Toggle dark mode when the switch is clicked

observeEvent(input$dark_mode, {

if (input$dark_mode) {

session$setCurrentTheme(bs_theme(version = 5, preset = "darkly"))

} else {

session$setCurrentTheme(bs_theme(version = 5, preset = "default"))

}

})

# Reactive values to store selected stocks

selected_stocks <- reactiveVal(NULL)

# Only update the stocks to fetch when the submit button is clicked

observeEvent(input$submit_btn, {

# Show a SweetAlert notification

sendSweetAlert(

session = session,

title = "List Submitted",

text = "Your stock list has been submitted. Results will appear soon.",

type = "success",

timer = 3000,

showConfirmButton = FALSE

)

# Update the selected stocks

selected_stocks(input$stock_selector)

})

# Get full list of stocks to retrieve

stocks_to_get <- reactive({

stocks <- selected_stocks()

# Ensure we have at least one stock to display

if (length(stocks) == 0) {

return(NULL)

}

return(stocks)

})

# Reactive expression to get and process stock data

stock_data <- reactive({

# Validate that we have dates and stocks

req(input$date_range)

req(length(stocks_to_get()) > 0)

# Download data

tq_data <- tq_get(

stocks_to_get(),

from = input$date_range[1],

to = input$date_range[2],

get = "stock.prices"

)

# Check if we got data

req(nrow(tq_data) > 0)

# Calculate returns

returns_data <- tq_data %>%

group_by(symbol) %>%

arrange(date) %>%

# Calculate daily returns

tq_transmute(

select = adjusted,

mutate_fun = periodReturn,

period = "daily",

col_rename = "daily_return"

)

# Join the returns data with original price data

returns_with_prices <- returns_data %>%

left_join(

tq_data %>% select(symbol, date, adjusted),

by = c("symbol", "date")

)

# Calculate cumulative returns from the first date of the period

cum_returns <- returns_with_prices %>%

group_by(symbol) %>%

arrange(date) %>%

mutate(

# For each stock, calculate the cumulative return starting from the first date

cumulative_return = cumprod(1 + daily_return) - 1

) %>%

ungroup()

list(

raw_data = tq_data,

cum_returns = cum_returns

)

})

# Create downloadable data

downloadable_data <- reactive({

req(stock_data())

# Format the cumulative returns data for download

download_data <- stock_data()$cum_returns %>%

select(symbol, date, cumulative_return) %>%

pivot_wider(

names_from = symbol,

values_from = cumulative_return,

names_prefix = "return_"

) %>%

arrange(date)

return(download_data)

})

# Get company names for better labels

stock_names <- reactive({

# Create lookup from sp500 stocks

name_lookup <- setNames(sp500_stocks$company, sp500_stocks$symbol)

# Return

name_lookup

})

# Generate returns plot with highcharter

output$returns_plot <- renderHighchart({

req(stock_data())

cum_returns <- stock_data()$cum_returns

names_lookup <- stock_names()

# Convert to format suitable for highcharter

if(nrow(cum_returns) > 0) {

# Create highchart

hc <- highchart(type = "stock") %>%

hc_title(text = "Cumulative Returns Comparison") %>%

hc_xAxis(type = "datetime",

title = list(text = "Date"),

dateTimeLabelFormats = list(

day = '%e of %b',

month = '%b %Y',

year = '%Y'

)) %>%

hc_yAxis(

title = list(text = "Cumulative Return"),

labels = list(formatter = JS("function() { return (this.value * 100).toFixed(2) + '%'; }"))

) %>%

hc_tooltip(

headerFormat = '<span style="font-size: 10px">{point.key}</span><br/>',

pointFormatter = JS("function() { return '<span style=\"color:' + this.color + '\">●</span> <b>' + this.series.name + '</b>: <b>' + (this.y * 100).toFixed(2) + '%</b><br/>'; }"),

shared = TRUE,

crosshairs = TRUE

) %>%

hc_plotOptions(series = list(

marker = list(enabled = FALSE),

states = list(hover = list(lineWidthPlus = 0)),

lineWidth = 3 # Increased line thickness

)) %>%

hc_legend(enabled = TRUE)

# Add data for each stock

for(stock in unique(cum_returns$symbol)) {

stock_data <- cum_returns %>%

filter(symbol == stock) %>%

select(date, cumulative_return)

# Format data for highcharter - simplified approach

hc_data <- stock_data %>%

mutate(

x = datetime_to_timestamp(date),

y = cumulative_return # Keep as decimal for proper calculations

) %>%

select(x, y) %>%

list_parse2()

# Add series to chart - only use the ticker symbol in the name

hc <- hc %>%

hc_add_series(

data = hc_data,

name = stock,

type = "line"

)

}

# Return the chart

hc

}

})

# Generate data summary

output$data_summary <- renderDataTable({

req(stock_data())

cum_returns <- stock_data()$cum_returns

names_lookup <- stock_names()

# Summary statistics for each asset

summary_data <- cum_returns %>%

group_by(symbol) %>%

summarize(

Start_Date = min(date),

End_Date = max(date),

Total_Return = last(cumulative_return) %>% round(4),

Annualized_Return = ((1 + last(cumulative_return))^(252 / n())) - 1 %>% round(4),

Volatility = sd(daily_return, na.rm = TRUE) * sqrt(252) %>% round(4)

) %>%

mutate(

Company = ifelse(symbol %in% names(names_lookup), names_lookup[symbol], symbol),

Total_Return = percent(Total_Return, accuracy = 0.01),

Annualized_Return = percent(Annualized_Return, accuracy = 0.01),

Volatility = percent(Volatility, accuracy = 0.01)

) %>%

select(

Symbol = symbol,

Company,

`Start Date` = Start_Date,

`End Date` = End_Date,

`Total Return` = Total_Return,

`Annualized Return` = Annualized_Return,

Volatility

)

})

# Download handler for CSV export

output$download_data <- downloadHandler(

filename = function() {

paste("sp500_returns_", format(Sys.Date(), "%Y%m%d"), ".csv", sep = "")

},

content = function(file) {

write.csv(downloadable_data(), file, row.names = FALSE)

}

)

}

shinyApp(ui, server)Hosting Shiny Applications

Way to go: you just did your very first app!

Now, the question is… how can you share that with your audience? Luckily, there are several ways in which you can host your application1:

shinyapps.io (by Posit): by and large, this is the easiest option for hosting Shiny apps for beginners. Fully managed, no server setup required

Posit Connect: enterprise-grade publishing platform, supports Shiny (

RandPython), Quarto, Dash, Flask, and more. It offers authentication, scheduled reports, and usage analytics. Suitable for internal tools and collaborative data productsDocker: containerize Shiny apps for portability and reproducibility. Useful for deployment in Kubernetes or cloud-native environments. Can be combined with CI/CD workflows

Hosting our application

Using the first option for deployment, inside your RStudio session, hit Publish and then select shinyapps.io. This option prompts a screen where you can log into your account. You can create a free account and host a limited number of applications in a free-tier option

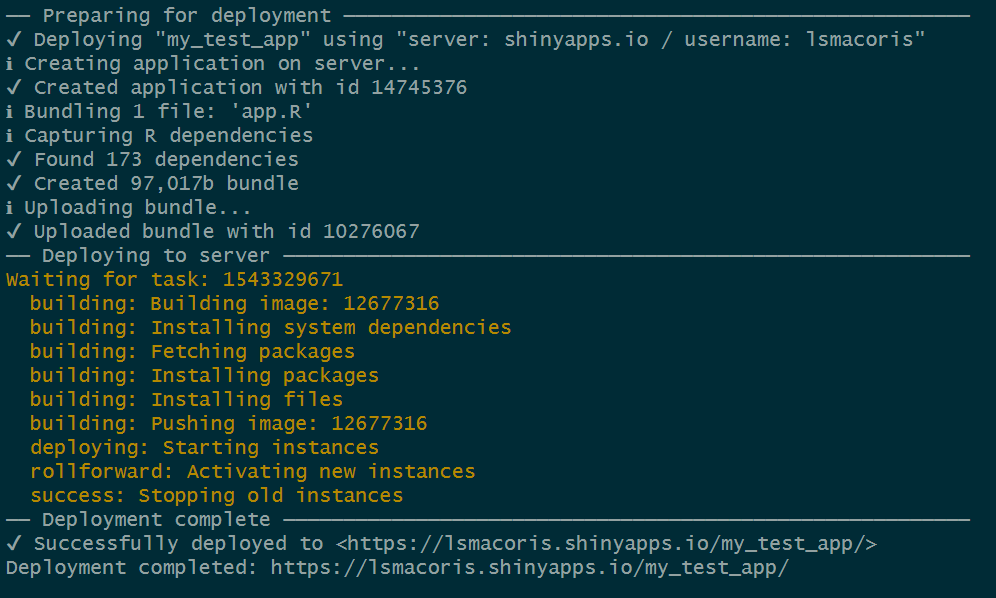

After following the instructions, you should see your app going live on the internet straight from RStudio’s command line:

- Curious to see the outcome? Check the live app here